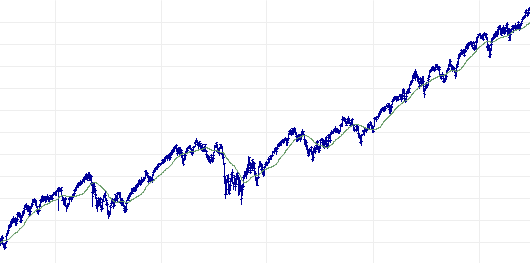

The stock market hit another performance record yesterday. That is not news because we’ve hit plenty of performance records lately as the stock market continues its five+ year record-making accent that started in March 2009. A glimpse of the five-year performance of any sector of the stock market chart (the S&P 500 in this case) would lead us to believe that the stock market is a wonderful and safe place to keep you money.

Chart of the 5 year value of the S&P 500 index:

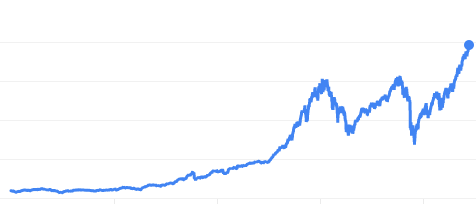

Yet the longer term perspective shows us something much different. The stock market over our lifetime – and especially since 2000 – has been wildly volatile and risky. The most distinguishing characteristic of the stock market in the 21st century has been that huge drops in value happen suddenly after periods of fantastic performance – exactly like we’ve seen for the last 5 years.

Chart of S&P 500 Index value since 1970:

We know only three things about the stock market’s future performance: 1) It will go up over the long term. 2) It will go down in short term corrections. 3) The corrections come quickly sharply, and unexpectedly after periods of great increase in value. I’ve often summarized the future market performance for my clients in another way: “At some point it will be higher than today; at some point it will be lower than today; you can’t predict when”. This has always been true and it will always be true in the future. (This statement summarizes why I no longer see value in remaining a Registered Investment Adviser).

Based on everything we know about the stock market, investors should be scared of a coming correction in value.

So what to do about it? Nothing really. If you plan to be invested for more than another decade or longer then there is no scientifically and mathematically justifiable reason to make a change t your strategy based on this realization. But if you are approaching retirement, it makes sense to diversify into investments that lock in the recent record values.

Finally, if you believe that a sharp market correction is coming, it makes sense to consider how that will impact your life other than your personal investment portfolio. Expect a return of the credit crunch. Expect political blame. Expect recession and layoffs. Expect it to hurt consumer spending. Expect it to affect real estate values. Have access to cash and liquid resources. Don’t pretend that you saw it coming because that doesn’t help anybody.

Leave a Reply to Tony Novak, CPA, MBA, MT