The purpose of tax planning is to reduce tax liability by taking measures that cost less than the benefits received. The tax planning process typically begins with an analysis of the taxes paid now or in the last period, then moves to a pro-forma calculation of taxes in the current and future periods. It is always based on projected financial results and the best available information at the time the plan was made. Some type of strategic brainstorming is used to identify possibilities to reduce the specifically targeted tax that is anticipated in the pro-forma. That’s where a checklist is helpful. Next we apply a “what if” calculation to identify the potential savings of each strategy.

This checklist list is not meant to be exhaustive but rather provides a starting point for discussion of tax and financial planning possibilities. I expect to add to my checklist or modify it over time.

- Available tax credits

- Health Reimbursement Arrangement

- Qualified Small Employer Health Reimbursement Arrangement

- Health Savings Account

- Education Assistance plan

- Accountable reimbursement plans

- Special partnership and limited partner allocations

- Non-taxable reimbursements

- Timing of trust fund disbursements

- Split dollar cash value life insurance

- Deferred compensation plan

- Segregation of non-professional income

- Employee vs contractor allocation

- Employer-provided IRAs

- Profit sharing plan

- Pension Plan

- Employment of family members

- Family limited partnerships

- Qualified Small Business stock

- Gifting of income-producing assets to family members

- Donating appreciated stocks to charity

- Family trusts

- Charitable lead trusts

- Charitable remainder trusts

- Sale and lease back arrangements

- Combining passive losses with passive income

- Oil and gas investments

- Registered tax shelter

- Conservation easements

- Eliminate AMT sources

- Delay social security by using other taxable sources of income first

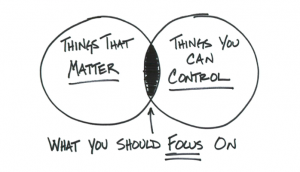

A simple approach is to briefly consider whether each of the strategies might be available and appropriate, then list a short advantage and disadvantage of each. Based on these preliminary analysis, it is then possible to begin ranking the possibilities in terms of their cost/benefit and the net impact on tax savings and overall financial planning. The illustration above identifies these results as “WHAT YOU SHOULD FOCUS ON”.

The best way to prepare a useful tax strategy forecast of results is to prepare a pro-forma tax return calculation using the best available information at the time of the analysis. Fortunately, our software makes that easy to do for our clients today.

I am pleased to arrange a discussion of tax planning with a small practice professional who might be interested in how to safely reduce their tax burden.

Leave a Reply