Despite the short work week abbreviated by the holiday, I learned quite a bit:

Web and social media

My ability to “pull” web traffic from search engines far exceeds my ability to “push” readership through social media platforms. That even includes paid promotion on social media to the extent that budget would allow for testing.

My 13 year old small business web site www.tonynovak.com is undergoing a makeover intended to organize the 300+ pages and resources into four functional management areas: 1) taxes, 2) accounting, 3) healthcare and 4) financial planning. Also, the page layout is revised and simplified to be more friendly to mobile device users. The new web page format is done, more directories will be added. I suggest that other small businesses may want to consider some of these same issues with their own web sites.

If you’ve invested time to developing content online, is it being read and does it contribute to your bottom line? A particularly good article on this topic appeared this month in Harvard Business Review, “Why No One’s Reading Your Marketing Content”, by Jayson DeMers, November 14, 2014, https://hbr.org/2014/11/why-no-ones-reading-your-marketing-content

Here are my notes in digest version:

– “only a quarter of content marketers actually invest in distribution, even though more than half recognize that it’s a critical need. “,

– “search contributes about a third of the traffic that websites receive” (my experience has been 85% to 90% but I don’t know why other firms have a different experience)

– “The principles of good search-engine optimization (SEO) must be applied to every piece of content as you create it, not just after-the-fact, in the metadata”.

– “brand journalism” = “using good writing and storytelling techniques to create high-quality marketing messages”

– Paid distribution – Press release services and tools such as Outbrain enable you to get your content onto major platforms

– Services that focus on interest group distribution: BizSugar.com, Inbound.org, Reddit.com.

– Relationships with influencers – Who are they? What do I want them to do?

– Measurement and monitoring: Google Analytics (My comment: I think this is the fox watching the hen house. I use Sitemeter for monitoring instead. Maybe this is just a CPA/auditor’s mentality).

My comment posted following the article’s web page observes that readership may only be the first step but is not the magic bullet to online marketing. In my case building online readership has been relatively easy in the sense that traffic has grown without any great effort on my part (I haven’t done any of the things suggested in the article). Converting content readers it to paid business is much more challenging IMO.

Trademark enforcement

Trademark enforcement can be an enormous challenge to a small business. I was successful in using social media’s fair use policies to put pressure on trademark violator. Freedom Benefits went after a company in Alabama marketing under the name “my Freedom Benefits”. It’s not easy, but I am learning what works and how to use the tools effectively. In hopes of avoiding problems in the future, I expanded http://freedombenefits.net/about-us.html to include reference to all my 50 state and DC insurance licenses.

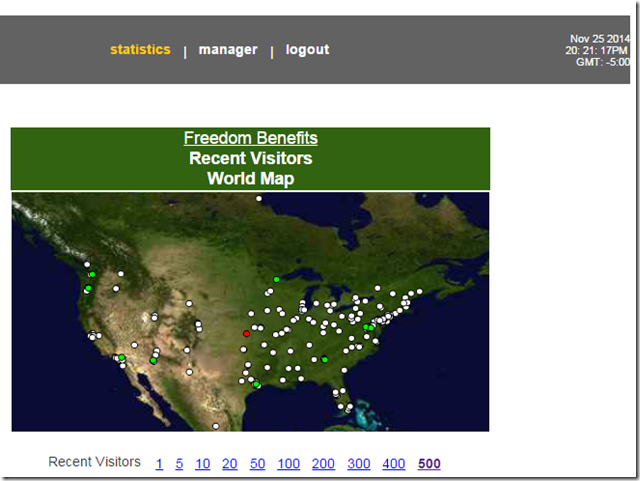

I verified that our traffic is distributed in accordance with US population, i.e. we serve all areas equally. This screenshot shows one day’s visitors.

Employee benefits

Taxation of employer-provided health benefits is a lot trickier than it used to be, thanks to the Obama administration pushing its new vision of how the landscape ought to look. I put out a summary article at http://freedombenefits.org/University/summary-of-tax-issues-for-employer-provided-health-benefits.html

Related to this, the list of “essential” points about health reimbursement plans grew to an unmanageable 18 at http://tonynovak.com/article/18-things-small-businesses-must-know-about-HRAs.html. I don’t know how to make the article more readable.

Tax planning

An interesting and important tax law case of interest to contractors was decided earlier this month and I just read the brief last night. A building contractor in Idaho spent about $80,000 per year sponsoring his son’s in motocross racing activities. The deductions were denied by IRS but then ultimately upheld by the tax court. The case is important for its educational value on the distinctions between allowable and disallowed Section 162 business deductions, Section 179 asset purchase deductions and Section 6662 accuracy related tax penalties. I expect that accountants who focus on these tax issues for small businesses will cite this case referred to as “Evans vs. Commissioner” in their advice to clients. I have the PDF of the brief if somebody wants to read it.

Nonprofit

BaySave ought to be doing more to encourage donations of boats and vehicles by helping donors with the tax donation paperwork.

FP had this to say: “

When individuals donate cars or other forms of property valued between $500 and $5,000, they must file IRS Form 8283 for tax deductions. If the client wishes to donate a car, he or she needs to describe the condition of the car and explain how its value was determined. If another form of property is being donated, the client needs to state how and when it was initially obtained.

Clients also need a receipt from the charity, along with written documentation indicating whether the property will be sold or used by the organization. Deductions of more than $5,000 require written appraisals from qualified professionals.

Donors themselves have to keep track of the documentation for such donations in the event of an IRS audit, and can’t rely on the charity”

Financial planning (an unfinished article)

Financial planning for dramatic life change

Like many of my MBA business school peers in the go-go years of the early 1980s, my personal financial goal was to generate enough net worth and income to retire at age 55. I made a plan; I followed it; and it was mostly successful. But what I failed to consider was the devastating impact of events that I did not plan for. As a result, I am restarting a financial plan at age 54 from scratch when I expected to be done by now.

The three life events that most dramatically affect personal financial plans are parenthood, disability and divorce. I experienced all three in the first decade of my working career. In addition, my financial results were even more severely impacted by two additional factors: violent crime and hurricane Sandy. I was the target of a criminal assault that resulted in a second extended period of disability in my peak career years. Then, most recently, the combined effect of sea level rise and hurricane Sandy devalued my real estate.

So the two most significant questions are: 1) What can you do to prepare for these types of events and 2) What can be done to recover from them? This is what I’ve learned so far.

Robust Mental Health

It is absolutely clear to me that the most important factor in my ability to adjust and succeed is robust mental health. Now I’m not saying that I’ve actually been a model of robust mental health but I am saying that I’ve learned that it is the most important factor to ultimate success.

In a nutshell, I’ve learned the importance of following the serenity principle: “Change the things you can, accept the things you cannot change and learn to know the difference. After my recent injury I had to learn the lesson taught by author/doctor Claudia Osborne:

I know that other people feel inspired by my story of physical, career and financial recovery. I don’t feel inspired, I just feel like I have more pressure to perform now to make up for the lost time. Beyond that, I don’t presume to have anything to share on the topic of mental health. I just know that it is the most important factor in rebounding from the impact of unanticipated events like this.

Impact of unplanned events runs both directions

The impact of unplanned events can be positive as well as negative. The fact is that our projections of the future’s finances are only guesses We really don’t know. I have been the beneficiary of a financial windfall in the past and it is reasonable to think that I might be the beneficiary of other unknown events in the future. I would definitely agree with those you say that luck favors the well-prepared. By being active, “out there” and fully engaged in life I increase the potential of benefitting from future unknown events.

Planning may be foolishness

I am willing to accept the proposition that financial planning is folly.

The marina

Things are looking up ever-so-slightly for the battered recreational fishing industry. I posted this on www.Moneyislandmarina.com Facebook page:

What Money Island Marina has to be thankful for this Thanksgiving:

1. Our great customers and community

2. Bruce, simply the best marina manager around!

3. The 25% reduction in Atlantic commercial striped bass harvest for 2015. This huge reduction in commercial harvest by ASMFC is the best thing to happen to mid-Atlantic recreational fishermen in decades.

4. The ongoing success of the summer flounder management system that is improving numbers and size of catch.

5. Lower gas prices that now appear will remain low throughout the 2015 boating season.

6. Our physical capabilities to extend the boating season from March into December since the big fish seem to come early and later each year.

7. NJanglers.com community, the best local fishing forum on the web! We will be posting more stories and photos on NJanglers and less on Facebook in 2015.

We’re still working on completing our Clean Marina Certification and I ran into Robert Smith at 757-392-3644 who might be able to help with marina safety requirements. Meanwhile, I’m working on an essential loan application with New Jersey Economic Development Authority.

Hopefully the last preparations before winter are underway with two super-strong and expensive stainless steel piling guides that will keep our fuel station docks (the most vulnerable to violent storms) from destroying the new piling.

Apparently the big stripers are still coming into the bay and might be here before Christmas! (sigh)

Personal health

I’m trying a new morning routine with 15 minutes of no screen time adding:

- Lemon water

- Set and affirm goals

- Stretch

- meditate

http://www.inc.com/drew-hendricks/6-better-ways-to-start-your-morning.html

Leave a Reply