This isn’t the type of tax blog post that I normally write. But after decades of writing and over 2,000 tax-related posts, columns and other publications, I sense that our tax system is spinning out of control, pulling our nation into a death spiral. It is time to speak out.

Almost three decades ago I was accepted by Villanova Law School as the first Masters of Taxation candidate who was neither a CPA (at that time) nor an attorney. There was a push for diversity in the student body at that time. I was a young MBA working is solo practice as a Registered Financial Planner (no longer a recognized credential) and a Registered Investment Adviser. My work as an evening school instructor and creative work in employee benefit plan design apparently caught the attention of the admissions office to allow me to sneak in and broaden my background in tax policy. I still recall an early lecture in a course “Introduction to Taxation” where the professor argued that the primary duty of a democratic government was to tax its citizens. I resisted the concept at that time, but now recognize that it is true.

The primary function of government

Other publications list “preserving order”, “defend against foreign enemies”, “manage economic conditions”, “redistribute income and resources”, “provide public services”. and “prevent externalities” (like pollution) as the primary functions of government. Yet these functions are only possible for a government with the financial resources to do so. Government’s success in collecting taxes precedes its ability to tackle any of these other listed functions. It is accurate to say that the primary function of government is to collect taxes from its citizens.

The failure to collect tax

We are on an unsustainable path of financial irresponsibility. The failure to assess tax, the failure to collect tax, and the failure to allocate tax collections as intended by elected government are all serious problems today. It’s never been easier to get away with being a tax cheat. We like to say “crime doesn’t pay” but the evidence says otherwise. The fact is that is you are a person of substantial means who chooses to cheat on your taxes then the large probability is that you will get away with the cheating. Now with the ‘tone at the top’ encouraging this behavior from the White House, we should expect to see a further rise in tax cheating.

Tax cuts do not pay for themselves

There is a persistent false rhetoric that “tax cuts pay for themselves”. It is important to recognize the existence of plenty of high quality research in this area and to repeat that there is no credible evidence that tax cuts pay for themselves. Tax cuts eventually generate, at most, a third of the amount of trimmed revenue. A widely cited study by the Congressional Budget Office concluded that economic growth from a 10 percent cut in individual income tax rates would, at best, recover 28 percent of the lost revenue. At worst, the study concluded, a tax cut can hurt the economy through the negative economic impact of higher deficits. The Congressional Budget Office now forecasts that by the middle of 2019 we will enter into a decade long contraction of Gross Domestic Product that is made worse by the 2017 Tax Cuts and Jobs Act.

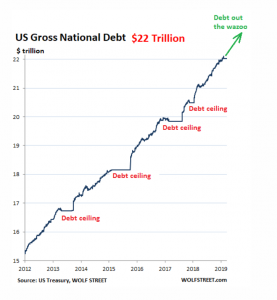

Debt doesn’t matter until it does

Just like a person paying living expenses on a credit card, the debt doesn’t matter until they need to make a payment or get an increase in the spending limit. That’s where we are now. It is increasingly difficult for our government to make its debt payments and another larger increase in debt ceiling will be needed in only a few months. Future government shutdowns will likely be worse than in the past. A shut down government, broke and ineffective, and the resulting public chaos, all from inadequate tax revenues combined with undisciplined spending.

What’s the answer?

Fortunately there is a clear and effective solution. We need financial professionals, not politicians looking for votes, in charge of our tax system. But let’s not hold our breath waiting for that to happen!

Leave a Reply