A friend asked me to review the tax return of a single retired relative living in Florida. The simple question was why were here taxes so much more in 2017 than in 2016? She offered to pay for the review but I insisted on doing it as a no fee/no obligation courtesy. I might have charged a fee if I found a way to make a significant difference. She lives on a small retirement plan distribution plus social security. This makes it tough to do any type of tax planning.

The technical reason for the tax increase easy to explain by tracing it back to a one time retirement plan distribution, It could have been done as a tax-free rollover but it is too late to worry about that now. (The lesson: ask for tax advice in advance, not after the fact!). At this point there is little I can offer in term of tax planning.

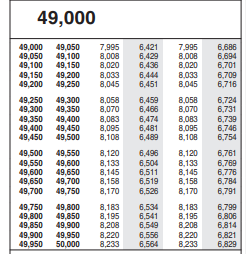

However, I was struck by the larger picture. Here I was looking at the tax return of a single woman maintaining a house in Florida with under $50,000 taxable income and over $8,000 in federal income taxes due! It’s just too much! I pointed out that her taxes will drop by about $600 under the new lax law in 2018.

However, I was struck by the larger picture. Here I was looking at the tax return of a single woman maintaining a house in Florida with under $50,000 taxable income and over $8,000 in federal income taxes due! It’s just too much! I pointed out that her taxes will drop by about $600 under the new lax law in 2018.

Even so, tax of $7,500 is not sustainable. I know many more affluent people who pay less in total taxes. I feel her pain.

Leave a Reply