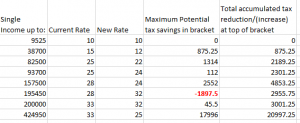

While most taxpayers get a decrease in marginal tax rates some single taxpayers will face higher marginal tax rates. This means that a single taxpayer with taxable income of $195,450 will see significantly less of a tax cut than a single with taxable income of $157,500. This does not mean that these taxpayers will necessarily see a tax increase or decrease. The marginal tax rate is only one factor that is considered in the overall tax calculation. For further explanation see “The three basic principles of individual tax reform“.

Leave a Reply