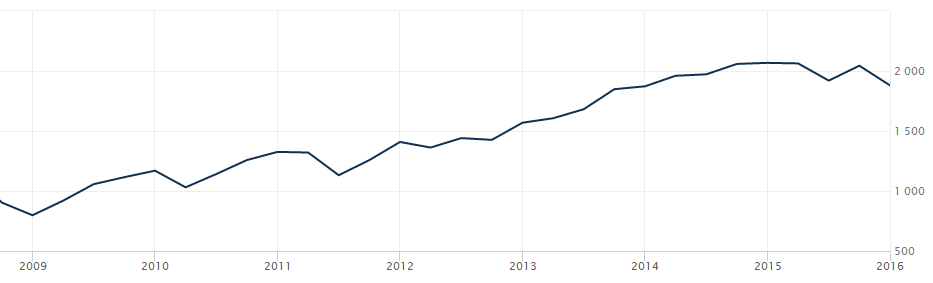

In case anyone has not noticed, the stock market’s performance stalled a year ago after 6 years of almost straight line growth. We hit bottom in the ‘great recession’ in 2009 and and then values tripled over the next six years. Since last January we’ve lost value.

The overall long term return on investment for many individuals has not been impressive because many were invested before the 2008-2009 crash.

My point is simply that need to reconsider that stock market returns may not be the simple and easy salvation that we had hoped when we – financial planners and baby boomer clients – developed our retirement savings strategies. Of course we realized this in 2009 and many will be reminded of it again in 2016.

A blog post this week in WSJ suggests that we need to rethink asset allocation. I agree, but that does not go fat enough. Diversifying assets over a wider range of possibilities, including the use of non-traditional investments, may be the best way to boost returns and reduce risk. Financial planners are unlikely to ever endorse investments outside of the domain in which they manage and derive fees. That is a primary drag on many diversification possibilities right now. The other deterrents are the cost of analysis and ongoing cost of management. Eventually, perhaps, crowd-funded investment options may help fill the gap.

Leave a Reply