(This post is for 2015. For 2016 tax return average rates, see this schedule).

I’ve drawn some attention lately, both positive and negative, for my two personal beliefs that: a) tax preparation industry fees should be bench-marked in some manner, and, b) that fees ought to be available to consumers in advance of making a request for service. I should be clear that this is purely a personal value, not a considered business decision and not something that I endorse for others in the industry.

These are my benchmark fees for online remote tax preparation services for 2015 tax returns. The benchmark fees are not the actual fee that I may charge. In fact little of my work involves solely the preparation of a tax return. The actual fee will be stated in an engagement agreement sent via email and work does not begin until we confirm the agreement in writing.

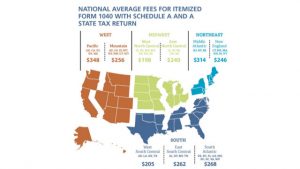

The term “benchmark fee”, as I use the it here, means that the fee is based on published average fees for the mid-Atlantic region reported by the National Association of Accountants. The Association reports fees from a wide range of tax preparers, not just CPAs. The figures below are increased by 5% over 2014 reported averages and then rounded up or down to the nearest $5 increment. The result, I believe, is a fee schedule that represents good consumer value for consumers who elect to use a CPA preparer through a cost-saving non-traditional online virtual professional service. In other words this fee schedule is intended and believed to be a good deal for an individual taxpayer working with a CPA to establish the lowest legal and sustainable tax liability.

Benchmarked fees for 2015 federal income tax returns

Form 1040 (individual income tax return) with Schedule A and one state tax income tax return, e-filed, with taxpayer’s copy delivered electronically: $330

Schedule C (business): $200

Form 1065 (partnership): $700

Form 1120 (corporation): $900

Form 1120S (S corporation): $855

Form 1041 (fiduciary): $500

Form 990 (tax exempt): $750

Form 940 (Federal unemployment): $75

Schedule D (gains and losses): $125

Schedule E (rental): $140 per rental property

Schedule F (farm): $175

The list includes only the most common tax forms, not all tax forms.

Tax preparation fees do not include accounting procedures necessary to obtain the figures for tax returns nor the cost of research to establish documentation of sustainable positions.

Leave a Reply