Here’s an update in bullet point format:

Here’s an update in bullet point format:

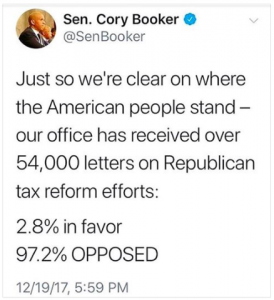

- Strong public opposition – It is clear from multiple sources now that the majority of Americans are opposed to the new tax law on the basis that it borrows from our future through massive deficit spending immediately. When the temporary tax cut expires our taxes are expected to increase to pay for the debt that was incurred. This “borrow now, pay later” is not a leadership strategy that most Americans will tolerate in their elected leaders so can reasonably expect political backlash ahead. The majority of Americans want to pay more, not less, toward solving our national problems and paying down debt. In particular, Americans consistently say that we want the rich who benefit from societal structure to pay a greater share than they have in recent decades.

- State opposition – Some state governments like New Jersey are strongly opposed to the new federal law and are already considering legislative responses that can mitigate the damaging effect of federal law. A state-endorsed charitable trust to handle multiple-year real estate taxes might be one approach. My concern is that many of these strategies are not within reach of ordinary working class taxpayers that live paycheck-to-paycheck. I hope that we see meaningful state response that affects workers at the paycheck level.

- It’s the law – It is also clear that our local opinions do not matter since this is, in fact, the new law of the land. Now our focus is on response to the new tax law, not political argument. (Just like ACA that many of us strongly opposed, once it became law the effective financial planners had to focus on working with it and help move clients away from the political debate stance). People who continue to argue politics without moving forward to the response stage will be left in the financial dust.

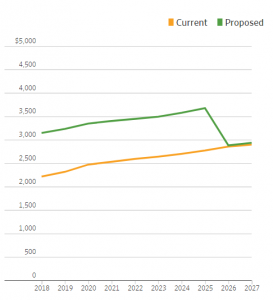

- Immediate net effect is modest but positive – The estimates coming for the Center for Tax Policy that the tax law will amount to an average increase in net household income of 2.2%. At the median level of income, this is about a thousand dollars per year. It’s not a game changer. But about one in five will see a tax increase so this law is a bigger deal to them. (Unfortunately I am among this group). People at higher income levels see a larger increase in their net income of about 4.4%. The long-term effects are potentially more serious but those are not discussed in this post. What matters most is how we spend this new free cash flow. In most U.S. households that first thousand dollars per year would be best used to boost cash reserves in a safe but not easily “spendable” format. Employee benefit advisers are already hard at work on suggestions.

- The tough issues – Most tax advisers I’ve read and heard from in person are not yet comfortable with the details of the new pass-through aspects of the law to discuss ‘what if’ scenarios with clients at this time. Clarity will come, so let’s be a little patient. It is safe to presume that we will see more personal service businesses incorporate to benefit from lower tax rates and pay their owners dividends rather than pass-through self-employment income. But it would be imprudent to do this immediately without more information.

- State taxes rise – State income taxes will rise for most businesses according to the informal research published by the Center for Tax Policy, since these taxes are based on federal taxable income. The federal law was designed to increase gross taxable income of businesses so tax increases will follow. Maryland’s governor and lawmakers are considering plans to return the windfall to taxpayers.

- 1 in 5 see immediate tax increases – People who have talked with tax planners like me early in the process are likely to be facing a tax increase than a tax cut. So my perception is distorted hearing so many stories of woe over the past week. Tax increases seem especially common for people who own property in New Jersey where real estate taxes can be a significant portion of your household budget. But nationally less than one in five taxpayers will see a tax increase in 2018.

- Strategies to reduce taxes or build cash reserves – The focus is now on strategies to reduce taxes. Additionally, it makes sense to re-examine strategies that were tax-driven in the past but might not be as relevant today. Strategies as simple as IRAs and 401(k)s are not as valuable today as other options to accumulate safe tax free cash reserves. On the other hand, it makes more sense than ever before to over expenses to a salary-deducted basis whenever possible. Most of what I read from other tax advisers is now focused on addressing these questions.

- Other taxes are more important – In the past federal income taxes dominated tax planning discussions. But with reduced marginal tax rates, these are not as dominant anymore. Self-employment and other wage-based taxes become relatively more important.

- Return of tax shelters – The new law seems to open the door for an increase in tax shelter strategies that have not been popular since 1986. But since these are subject to the complex and not even-more-complicated alternative minimum tax provisions, it makes sense to hold this discussion for a later date.

- Action plans – The earlier in 2018 that new strategies are adopted, the greater the tax savings. My approach is to make the easiest changes first, like updating employee benefit plans, and then take a longer time to make more difficult changes like a change in business format.

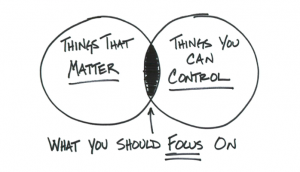

Much more will be published in the weeks ahead. For now it makes sense to focus on the obvious issues that impact us the most immediately: estimating 2018 taxes, adjusting wage tax and quarterly tax withholding, and updating employee benefit plans. As before, focus on the intersection of “things that mater” and “things you can control” will give the brightest possible results for 2018.

Leave a Reply