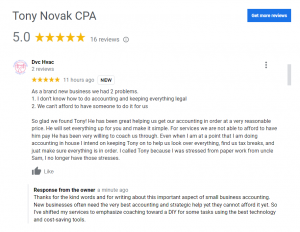

I woke today to find an email notice of another five star review from a small business client. I am grateful for the willingness of over 50 clients to share their comments on one of the various online business rating services. It’s pretty humbling, actually, that they are all organic five star reviews that they wrote on their own as a gesture of goodwill.

I’ve always been aware of the difference between our approach and the approach of other accounting firms that sets us apart. It is simple. I pay attention and ask how and when clients want things done. Then I customize my work accordingly, get an approval on a work plan, and hold each of us accountable for the outcome. We call that strategy “meet the client where they are”. It works. It pays off in five star reviews!

Of course, the trade off is that my approach in delivering customized service is expensive. Recent cost increases and talent supply shortages within the accounting industry widened my cost efficiency gap. I worried that the clients I loved serving would not be able to afford even the minimum fees I had to charge to keep my own firms afloat; let alone the cost of the top rate service I want to provide. As a result, I’ve been focusing on coaching a DIY approach for small firms. Today’s efficient technology can allow most small businesses to learn to handle their own bookkeeping, tax filings and other compliance work. It helps to have an experienced person overseeing the process.

In addition, small businesses need the most experiences advisers to hone in their vision, mission, goals, strategies and contingency planning to make all their hard work pay off. So far, only a few small business accounting firms have smoothly incorporated all of these services these into their core operations. (I have ideas on how other firms can do this, but that’s for another blog post).

Those are the functions this small business owner wrote about in this new review. In my opinion, those are the best practices available for the future of small business accounting profession.