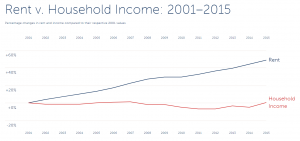

One of my persistent flaws as a financial adviser (and as an investor) is that I forecast market changes too early. That’s a timing flaw, not a flaw on detection of the trend. I’ve been negative on housing prices for a long time. This graph published in a Robert Woods Johnson report explains why.

When we combine the market distortions with environmental pressure, spiraling property taxes and other factors, then real estate loses its appeal. Some places like my coastal community have already seen an 8-% drop in value A wider market correction is coming, but apparently I do not know when.

Leave a Reply