We should recognize that tax rates for the wealthiest individuals and corporations will be higher in the future than they are today.

I stirred up a handful of comments yesterday on Wall Street Journal social media about the future of income tax rates. Some people apparently think that higher income tax rates are not possible or will not happen for some reason. A few people even suggest that even my proposal of such a scenario is unreasonable.

While varied opinions are always respected, I think that it is smart to recognize as a starting point in discussion of policy or financial planning that the top marginal tax rates for individuals and corporations will be higher in the future that they are today. Any other opinion would seem to require an ignorance of historical tax rates in the U.S. and disregard for the impact of this expended period of low top tax rates for individuals and corporations.

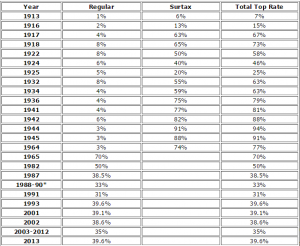

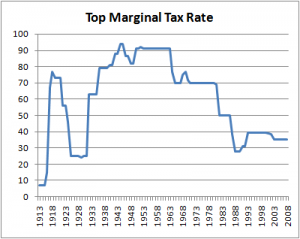

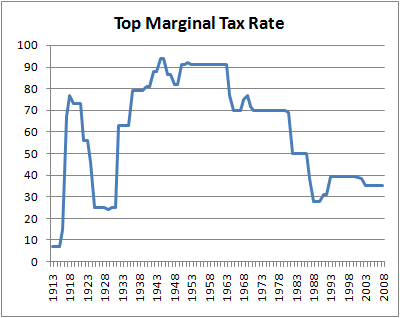

We are now in an extended period of the lowest tax rates in our country’s history. For almost 20 years – since 1988 – we’ve been in an unprecedented period of low tax rates for wealthy individuals. That period is correlated with a massive reallocation of our nation’s collective income and wealth from the middle class to the top 1%.

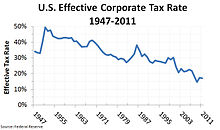

I presume that we are approaching the end of the era of wealth reallocation to the “1 percenters” and that failure to address this wealth reallocation trend would eventually have horrific societal consequences – but that’s far beyond the scope of this blog post. The purpose of this post is simply to establish that marginal income tax rates for individuals and corporations are LOW compared to historical standards.

I personally find that the wealthiest people, including both clients and non-clients who have expressed an opinion accept this position to be true. Yet in this nation of divisive attitudes I have sometimes felt attacked by simply proposing that an assumption of higher future tax rates ought to be the standard of sound fiscal planning.

top corporate tax rates in the U.S. over time

Leave a Reply