Category: Taxes

-

Tax deductible employee business expenses

The basics of an often-misunderstood tax topic If you are an employee with expenses related to your job, these expenses are not taxable income. If your employer reimburses these expenses separately from your wages then these amounts are not taxed and you need to take no further action. But if the amounts were included in your…

-

PA unreimbursed business expense deduction creates an audit risk

For he past few years the Pennsylvania Department of Revenue aggressively audited the tax returns of individuals who took a deduction for unreimbursed employee expenses on Schedule PA-UE. The topic was covered by the Pittsburg Tribune in June 2014. My quick online poll of professional tax preparers last summer indicated that the audit rate was near 100% of…

-

Help for last-minute tax filers

These final 20 day of tax season can be stressful on taxpayers and tax preparers. I will work at least 14 hours a day in order to meet my own work deadlines and contribute to the workload of other tax preparers. Yet it makes sense for a young accounting practice to reserve time for new…

-

Homeowner tax credits for energy efficient upgrades

Have you overlooked a small tax credit? The IRS offers two types of tax credits to homeowners in 2015 and 2016: the Residential Energy Efficiency Property Credit and the Nonbusiness Energy Property Credit. The first applies only to solar and renewable energy systems and is not discussed in this article. The second type of tax…

-

Beware of these tax penalties

Yesterday my attention was drawn to several small business tax penalty issues. 1099-MISC Several situations came to my attention where small businesses and especially home-based businesses are not aware of their requirement to file form 1099-MISC for payments they made last year. Heed this basic rule: If your business pays $600 to an individual or…

-

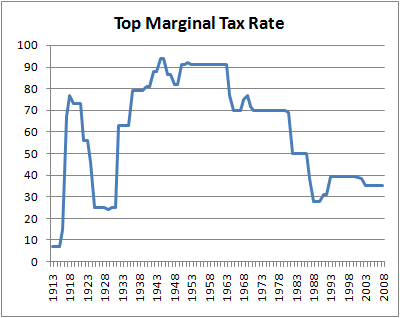

Why tax rates will be higher

We should recognize that tax rates for the wealthiest individuals and corporations will be higher in the future than they are today. I stirred up a handful of comments yesterday on Wall Street Journal social media about the future of income tax rates. Some people apparently think that higher income tax rates are not possible…

-

Two week reminder for corporate tax filing deadline

The March 15, 2016 deadline for filing most corporate tax returns is approaching quickly. To avoid penalties either the tax return or a request for an extension must be filed on or before that date. In either case, taxes due must be paid by that date to avoid extra penalties and interest, If your 2015…

-

“Pay half” tax preparation offer draws public discussion

H&R Block has caused commotion within the tax preparation industry last week with its “pay half” offer for new clients. Likewise, Intuit has annoyed some with its TurboTax advertisements suggesting that tax preparation is a simple do-it-yourself project. The TurboTax “It doesn’t take a genius” ad campaign belies the decades of training that tax professionals…

-

When can a tax preparer accept your word?

When can a professional tax preparer accept your word without documentation and when must a tax preparer rely on other contradicting information? These issues came up several times this week in my work. The guiding principles are listed in IRS Circular 230 but are frequently not understood by taxpayers. While almost half of all tax…

-

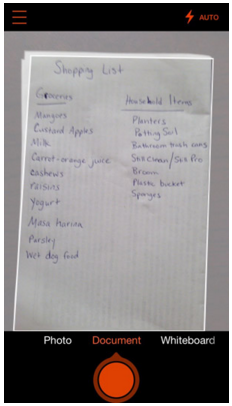

Mobile scanning apps for taxes and accounting

If you want to handle taxes or accounting on your smartphone or tablet, you need a mobile scanning app installed on your device. The two most popular apps that are completely free, have no premium upgrade option, include optical character recognition, and are available on all cell phone and tablet computer platforms are: Office Lens…