Executive Summary: Smaller Pennsylvania charities face revised state requirements for their submitted financial statements that may require additional advance planning.

May 16, 2018 is the IRS filing deadline for filing 2017 information with the federal government for most nonprofit organizations. Some organizations haven’t had a need to focus on the details of recent legal changes affecting small local nonprofit groups and charities in Pennsylvania until now. Pennsylvania Act 71 that was signed into law on December 22, 2017 amended the filing requirements for non-profit organizations that conduct solicitation activities within the Commonwealth of Pennsylvania beginning February 15, 2018.

Small Pennsylvania charities could be facing a significant reporting change this year that requires advance planning. Although the Pennsylvania registration renewal following deadline is not until November 15, 2018 for calendar year based organizations, it may be important to consider the impact of the change right now. The Pennsylvania filing requirement is based on specific data reported on the IRS form 990 so it makes sense to discuss and plan for both together.

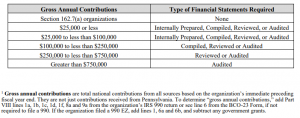

The “Instructions for Charitable Organization Registration Statement“, BCO-10 Instructions, were revised in January 2018. It includes the following section:

Note the dramatic change in financial statement requirements for charities as their gross annual contributions surpass the $100,000 and $250,000 level. (That aspect is not new and is actually more ‘lenient’ than prior law). A charity that raises $99,000 in a year can use an internally prepared financial statement. A charity that raises $100,000 must have that statement that is compiled or reviewed by a Certified Public Accountant. Once total contributions exceed $250,000,a review is the minimal requirement. A ‘review’ is the middle of three levels of attestation. A review is more than a compilation and less than an audit.

Also, notice the definition of “Gross Annual Contributions” is clearly defined and references a specific data field on the IRS form 990. This appears to be the change that might trip up some charities. Last year I sought guidance from the charities section of the Pennsylvania Department of State and found that a wider range of gross contributions could be excluded from the test for the COmmonwealth’s financial statement requirements. For example, a charity that received contributions of $100,000 from its founder/executive and $20,000 from the public could formerly opt to be exempt from the reviewed financial statement requirement. That exception no longer appears to apply.2.

A quick online review of the commentary of other CPAs indicates that most are focused on the changes applicable to somewhat larger charities. My focus is on the smaller ones because I work with more of these. I didn’t see any third commentary that addresses the issue illustrated in the example above.

So what does this mean to your small PA charity? If your charity is affected, this reporting requirement could add $1,000 or more to your annual compliance costs. While this is not much of a change for larger companies, it may be significant to smaller charities. This blog post is not meant as a summary of all of the changes, but rather just this one issue. Charity executives should review the new law ASAP if they have not done so already.

Executives and advisors for local charities sometimes ask me about the cost of a CPA compilation, review or audit in an abstract sense. I should stick to the standard “it depends” type of response but being a big-picture type of small business planner personality, I like to give more of a benchmark even it it might not be accurate in every situation. I typically say that a compilation for a typical small charitable organization costs 1.0% to 2.0% of gross contributions, a review costs 1.5% to 2.5% of gross contributions and an audit costs above 3% of gross contributions. Accountants sometimes discount their fees to charities when they have a personal affinity to the charitable cause and so this ballpark pricing reflects that observed discounting practice. A large portion of the cost is attributed to peer review requirements1 where the CPA must pay to engage a third party reviewer of this attestation work. This is an expensive and time-consuming process for a CPA.

Finally, consider that the timeline for this type of CPA work is typically measured in months, so it is important to start now even if your filing requirements isn’t until November.

I am pleased to work for Pennsylvania charities as both a paid and volunteer basis and would be pleased to further discuss this issue as it affects your organization.

1As a Delaware licensed CPA firm operating under a Pennsylvania temporary permit to practice, I was formerly exempt from the peer review requirement but this was adapted by my state effective July 2017. I built up a niche in this area of practice partly because my lower cost structure offered a competitive pricing advantage to smaller clients. I have not yet completed my first peer review but am now estimating he time requirement and cost of the program.

2 In early 2017 I wrote to and spoke with a representative of the Charities Section seeking clarification on what seemed to me to be ambiguous wording of the financial statement assurance requirement for internally funded private foundation charities. I used that clarification to advise some charities might be able to use lower levels of assurance in financial statements for Commonwealth reporting purposes. This publication appears to be different than the clarification I received at that time and would cause me to reverse that specific advice.

Leave a Reply