The topic of declining mid-Atlantic shoreline property values and accelerating taxes is a controversial topic, especially in the rich communities that have not yet felt the real impact of tidal inundation. Just talking about the serious problem almost got me killed years ago when I first started covering the topic for investors. (That’s a story for another time). But this multi-faceted real estate stress is coming and will hit harder and faster than most people realize. The new book “The Drowning of Money Island” speculates that the end result will be that only rich people will be able to own property at our historically working class towns.

When I point out that our poor rural bayshore community has the highest property taxes in the nation, some people seem skeptical of that claim. This post is meant to illustrate how declining property values lead to the highest property tax rates in the nation, measured as a percentage of property value.

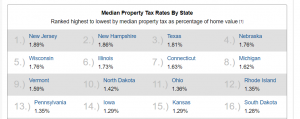

First, consider that the State of New Jersey has the highest property tax rates in the nation, as a state-to-state comparison. Consider this chat from The US Census Bureau, The Tax Foundation, and Tax-Rates.org. Most recent property tax surveys available from 2009:

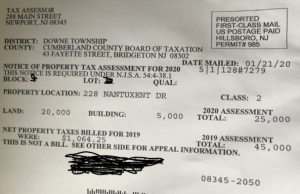

We see that New Jersey is listed as #1 highest with property taxes averaging 1.89% of the assessed property value. Now consider the local New Jersey bayshore region. This is an actual 2020 property tax assessment for a residential property that was purchased for $132,000 in 2006, renovated and valued at $175,000 and recently appraised at $5,000. The current assessed value is $25,000 because of the legal and professional expense of adjusting the assessment to the actual market value.

We see that the 2019 taxes were 2.3% of the assessed value, significantly higher than the state average. But is we calculate the tax as a percentage of market value, the effective property tax rate jumps to over 21%.

This is unsustainable. I am working through the nonprofit association Baysave and other organizations to make adjustments that will lead to sustainability even while flood water inundation accelerates the pace of change in our bayshore communities. Change is difficult and expensive, especially in New Jersey, but we will ultimately be successful simply because we have no other choice. Here in New Jersey we always do the right thing after we’ve failed at everything else first.

I’m please to discuss our current projects and long term investment opportunities in our emerging bayshore working waterfront industries and post-evacuation aquaculture expansion.

Resources:

Webinar: OWNING REAL ESTATE IN A DECLINING MARKET: STRATEGIES FOR SURVIVAL: WHAT YOUR AGENT AND MORTGAGE COMPANY DON’T TELL YOU, scheduled on demand

Leave a Reply