Residential home prices have a huge impact on my own family’s financial success* (I/my/me) and my clients (our/us). I have historically focused on this segment for my own investments and most of my clients are real estate investors, Realtors, builders, remodels and other contractors. So it is important for me to have a well-considered strategy and action plan to respond to current events affecting this market. Right now, inflation response leads that list of concerns over current events.

These are the considerations that contribute to my response strategy:

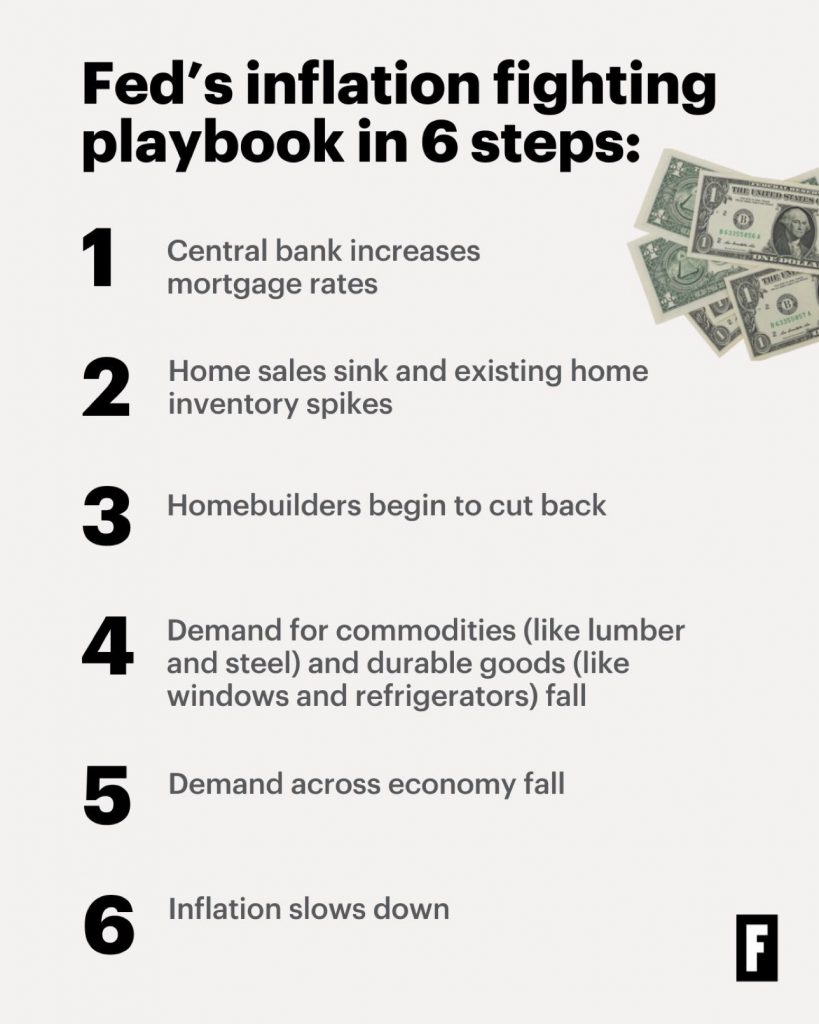

1. The Federal Reserve Bank’s plan to tame inflation mostly means targeting residential home prices. It is important to understand this as a starting point for developing response strategy. It’s not so much about gas, food, wages or other segments. It’s about housing. (See graphic).

2. I was plainly wrong in assessing that the residential real estate market peaked years earlier and that I should move my focus out of this market. (See my 2011 blog post). Among other issues, I did not recognize the dramatic impact of the Fed in holding interest rates so low and the dramatic impact of the pandemic on local home prices.

3. My investment focus shift away from residential housing (and clients working in these related fields) and into undeveloped land and aquaculture properties was not a necessary move, but may still prove to be a valuable strategy in the future.

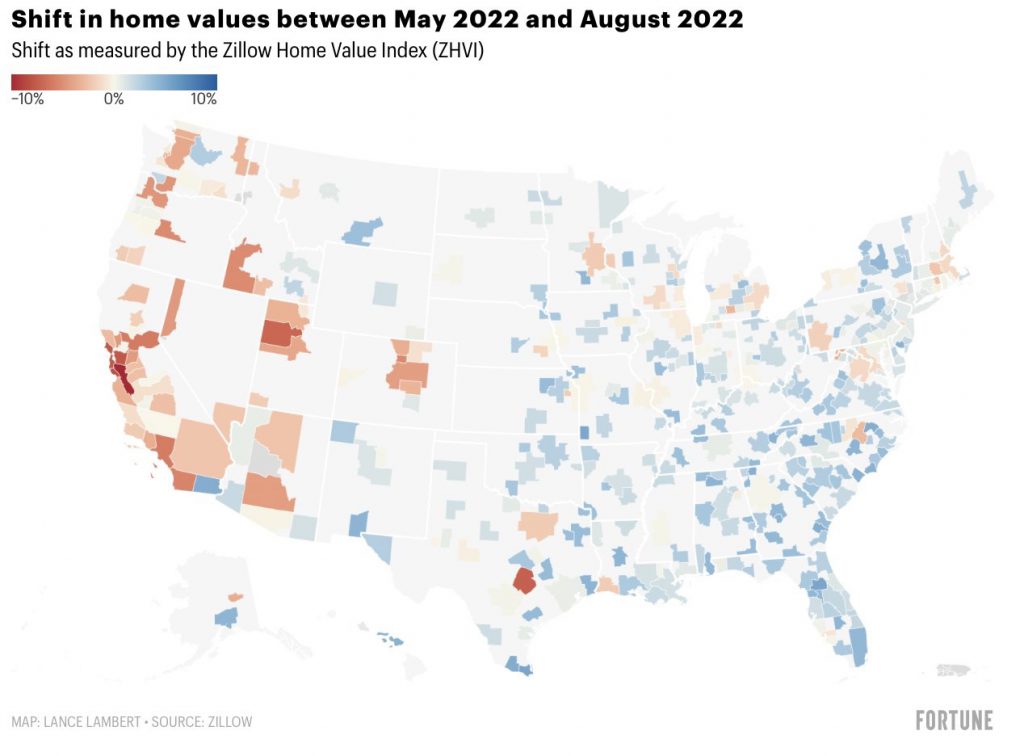

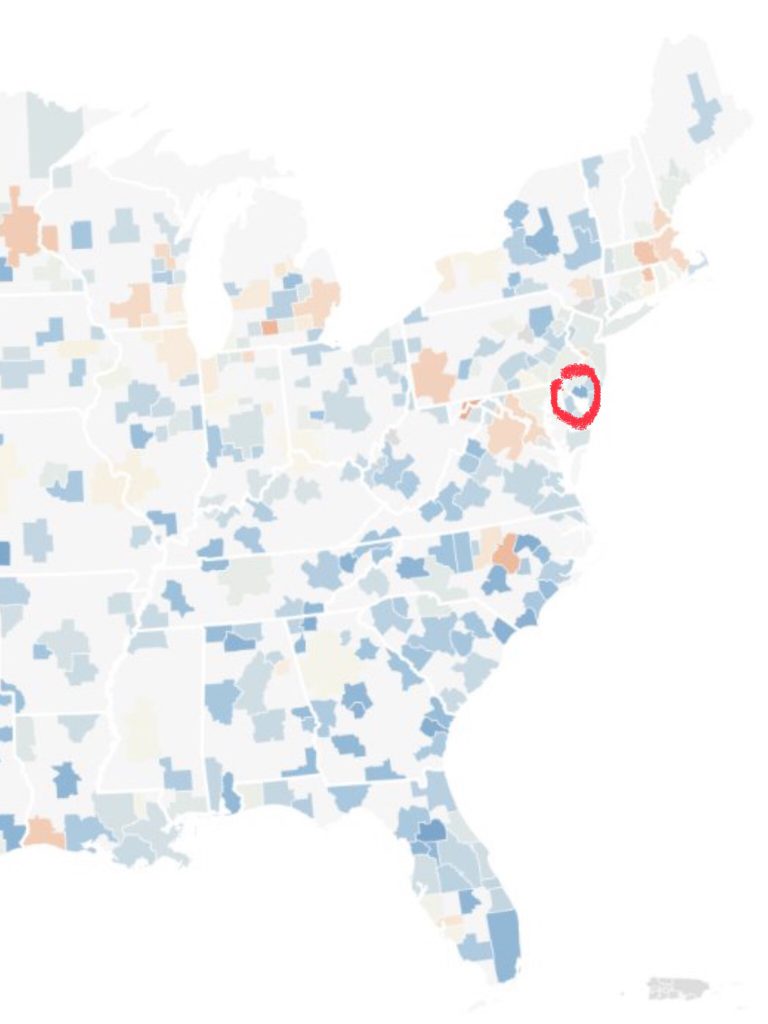

4. Our local Cumberland County, NJ neighborhoods suffered a 10 year decline in home values from 2006 to 2016. The residual impact of this trend continues as the reverse effect today. Our local zip codes were among the nation’s strongest performing home values from March to August 2022. (See Zillow maps).

5. Some neighborhoods here continue to offer the best home values in the country. Yes, this is an extraordinary statement with a significant conclusion. I expect that ‘outside’ investor interest will remain strong. This will create both opportunities and challenges.

6. As long as mortgage rates remain lower than the expected investment portfolio return (somewhere around 8%), then residential real estate will continue to be an interesting investment to my clients. The prevalence of seller financing will expand if mortgage rates are at or above this level because a high portion of homes have no mortgages here or could be financed as lease/sale deals to leave current mortgages in place.

7. Supply will improve. The price of building materials will decline. The availability of labor and services will improve.

8. Demand will remain strong. We have a housing shortage and that will not change in the short term.

Overall conclusion:

Local residential real estate is not immune to national trends but we will have a “soft landing” compared to other parts of the country. I am preparing my life and my clients for recession but expect that we will emerge operationally stronger a year from now. Cash flow will improve after that.

What next? I will continue to work with clients individually to develop strategies that work best for their unique situation and long term goals.

* I chose to not hold any assets personally as a long-term business and financial strategy , so “me” is not meant literally but refers mostly to family and related organizations.