Category: Accounting

-

Homeowner tax credits for energy efficient upgrades

Have you overlooked a small tax credit? The IRS offers two types of tax credits to homeowners in 2015 and 2016: the Residential Energy Efficiency Property Credit and the Nonbusiness Energy Property Credit. The first applies only to solar and renewable energy systems and is not discussed in this article. The second type of tax…

-

Beware of these tax penalties

Yesterday my attention was drawn to several small business tax penalty issues. 1099-MISC Several situations came to my attention where small businesses and especially home-based businesses are not aware of their requirement to file form 1099-MISC for payments they made last year. Heed this basic rule: If your business pays $600 to an individual or…

-

Two week reminder for corporate tax filing deadline

The March 15, 2016 deadline for filing most corporate tax returns is approaching quickly. To avoid penalties either the tax return or a request for an extension must be filed on or before that date. In either case, taxes due must be paid by that date to avoid extra penalties and interest, If your 2015…

-

Time to look ahead for work after tax season

Updating the resume and setting minimal earnings requirements Looking ahead to the end of tax season I became concerned with my lack of future work projects. So I updated my online resume and sent out a few inquiries. I also updated a cover letter to go with the resume that is not published online and,…

-

“Pay half” tax preparation offer draws public discussion

H&R Block has caused commotion within the tax preparation industry last week with its “pay half” offer for new clients. Likewise, Intuit has annoyed some with its TurboTax advertisements suggesting that tax preparation is a simple do-it-yourself project. The TurboTax “It doesn’t take a genius” ad campaign belies the decades of training that tax professionals…

-

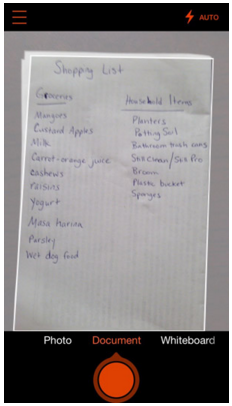

Mobile scanning apps for taxes and accounting

If you want to handle taxes or accounting on your smartphone or tablet, you need a mobile scanning app installed on your device. The two most popular apps that are completely free, have no premium upgrade option, include optical character recognition, and are available on all cell phone and tablet computer platforms are: Office Lens…

-

The $100 bill is doomed

The U.S. Department of Treasury says that we have a Trillion dollars in circulation in paper $100 bills. We’ve known for a while that much of this is kept outside of the United States and that a large portion of the $100 bills actually in circulation are used for illicit activities including drug trade, human…

-

Too many chefs spoil the financial plan

The saying goes “Too many chefs spoil the broth”. I saw that concept play out twice this month with the tax liabilities of two small businesses. These otherwise successful entrepreneurs used too many financial advisers without designating one of them as the chief financial officer in charge. The results were nearly disastrous. Potential disaster #1: S-corp cash…