Category: Financial Planning

-

Fiduciary rule should raise awareness of more important issues

I have mixed feelings about the new federal push in retail financial market known as the “fiduciary rule”. Depending on the specific facts, there is a strong argument to be made on either side of the issue. One thing that is certain, however, is that the new rule is intended to increase public awareness of the value of…

-

What is the value of a financial adviser?

One of the surprise lessons of this tax season was learning how many sophisticated and successful clients are paying more than five figures annually for what essentially amount to picking mutual funds. Many of the cases I saw while preparing tax returns were fees paid through Charles Schwab for funds offered in retirement plan accounts…

-

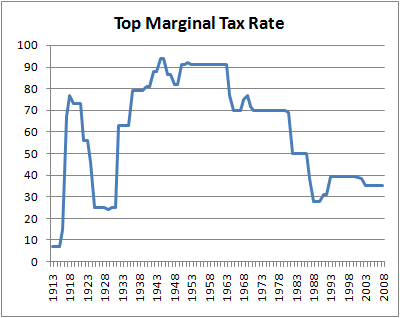

Why tax rates will be higher

We should recognize that tax rates for the wealthiest individuals and corporations will be higher in the future than they are today. I stirred up a handful of comments yesterday on Wall Street Journal social media about the future of income tax rates. Some people apparently think that higher income tax rates are not possible…

-

America’s evolving attitudes about inheritance

When it comes to money, we are still not communicating well with family and advisers. Estate tax laws aren’t helping. A new report by Hearts and Wallets provides some fascinating insights on America’s evolving attitudes about inheritances, including: “only 27% of the parents surveyed have told their children how much they are likely to inherit”…

-

Devastating impact of education costs

I worked on two personal income tax returns yesterday that serve as examples to further underscore the need for education finance reform. As an adviser I see plenty of these examples in working class families, these two just happen to be the latest. I know that my peers in the tax preparation industry will see…

-

Negative interest rates: what does it mean?

How current news affects financial planning Much of the world has entered into a period of negative interest rates with little economic growth. Here in the United States Federal Reserve Chair Yellen still says that interest rates will rise (and she knows better than anyone) but remain at historically low levels this year. Some doubt…

-

Too many chefs spoil the financial plan

The saying goes “Too many chefs spoil the broth”. I saw that concept play out twice this month with the tax liabilities of two small businesses. These otherwise successful entrepreneurs used too many financial advisers without designating one of them as the chief financial officer in charge. The results were nearly disastrous. Potential disaster #1: S-corp cash…

-

Three benefits of operating as an LLC

If you are self-employed, there may be at least three benefits of operating your business as a Limited Liability Company (LLC). In most states the cost is roughly about $200 to form a LLC and about $100 per year to maintain it. The potential benefits are: Liability protection – This is the usual reason, to…

-

The shrinking middle class

Pew Research Center published this graph that shows how the portion of people in the middle class has shrunk from 60% to 50% of all Americans over the past 25 years. The calculation defined middle class as someone with a total household income ranging from $41,900 to $125,600 for a three-person household in 2014. Source: http://money.cnn.com/2015/12/09/news/economy/middle-class/index.html

-

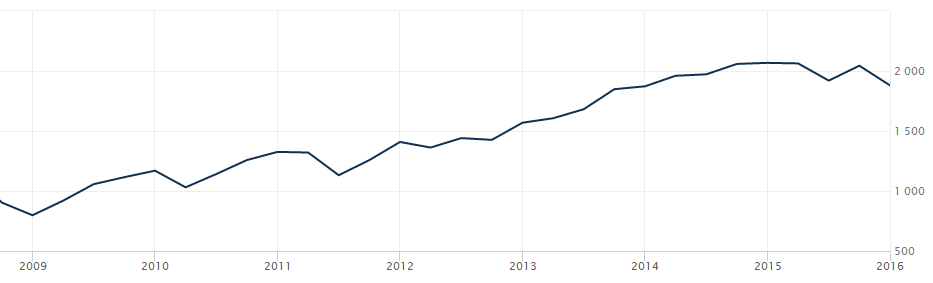

What the stock market did while you were out

In case anyone has not noticed, the stock market’s performance stalled a year ago after 6 years of almost straight line growth. We hit bottom in the ‘great recession’ in 2009 and and then values tripled over the next six years. Since last January we’ve lost value. The overall long term return on investment for…