Category: Investment

-

Bala Cynwyd investment scam hits close to home

Hardly a week goes by that I don’t read about some homeowner being defrauded by an unscrupulous building contractor or an elderly person being lured into an investment scam. I’ve written and talked about dozens of such schemes over the past three decades. Yet year after year the stories keep coming. The latest incident occurs…

-

We all love a good investment story

The hunger for investment stories will never cease nor be replaced by automation. Yet there remains no conclusive evidence of the value of active investment management. My comment is inspired by the great article at http://www.businessinsider.com/meet-blackrocks-impact-investing-team-2016-6 [contact-form-7 id=”3893″ title=”Boilerplate Contact”]

-

Investing in an economic collapse

Billionaire investor George Soros is in the news again for returning to investing word after a long hiatus. He is known for his skill in spotting risk and betting against overpriced markets. His moves are generally seen as predicting a Hillary win, a negative performance of U.S. stocks, and are and significantly gloomier worldwide economic…

-

Help wanted with 401(k) plans

The administrative branch of the federal government is behind a recent curious effort by the Department of Labor to cut retirement plan fees. It seems to be a case of “it’s not broke but we’ll fix it anyway and see if it turns out better”. Proponents argue that – all other things remaining the same…

-

The worst of residential real estate performance

I’ve been negative on residential real estate as a financial asset for at least the past 12 years but that’s perhaps mostly because I’ve personally taken such a beating in suburban Philadelphia and along the bayshore region in south Jersey. Ten years ago in 2006 this historic (c 1901) stone home in Bala Cynwyd on the…

-

Fiduciary rule should raise awareness of more important issues

I have mixed feelings about the new federal push in retail financial market known as the “fiduciary rule”. Depending on the specific facts, there is a strong argument to be made on either side of the issue. One thing that is certain, however, is that the new rule is intended to increase public awareness of the value of…

-

What is the value of a financial adviser?

One of the surprise lessons of this tax season was learning how many sophisticated and successful clients are paying more than five figures annually for what essentially amount to picking mutual funds. Many of the cases I saw while preparing tax returns were fees paid through Charles Schwab for funds offered in retirement plan accounts…

-

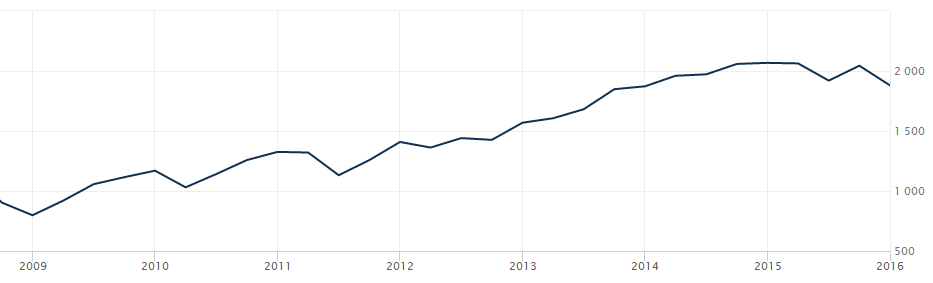

What the stock market did while you were out

In case anyone has not noticed, the stock market’s performance stalled a year ago after 6 years of almost straight line growth. We hit bottom in the ‘great recession’ in 2009 and and then values tripled over the next six years. Since last January we’ve lost value. The overall long term return on investment for…

-

Evaluating a private placement investment

This week I came across a situation where a friend was considering investing in an unregulated private placement deal. The friend is not a “qualified investor” as defined under the law and was probably actually relatively unsophisticated about investment issues. We have a mutual friend, an attorney, who was also unfamiliar with securities law and unable to…

-

Stock market crash in a nutshell

Over the past 60 days investors around the world have pulled more than $6 billion in investments from worldwide emerging markets. This caused worldwide stock prices to drop by about 10%. Much of this money has been reinvested in U.S. Treasury bonds. U.S. stocks have dropped about 4% so far as a side effect. The…