Category: Small Business

-

Puerto Rico debt crisis

We saw the approaching Puerto Rico debt crisis more than 30 years ago. This is my story of how I worked on the project at Merrill Lynch in 1983.

-

Small businesses may be falling behind in tax compliance

I noticed four trends among small business owners this past tax season: Asking for professional help too late. Clients ask for help or advice with taxes after year end but they have not maintained the appropriate bookkeeping records and compliance filings throughout the year. I found, for example, that plenty that did not track or prepare…

-

QuickBooks desktop error

Accountingweb.com carries a useful article today about one of the most common QuickBooks errors; one that drove me crazy when I used the desktop version of the software. However, the article skips over the most significant point, I think, in that this error is not an issue with the hosted version of QuickBooks. Regardless of…

-

What do Pennsylvanians think?

The exit polls taken by NBC News and reported by Wall Street Journal and others at today’s primary election may be the most comprehensive and insightful data we’ve seen in a long time. Some of the published results about what my Pennsylvania neighbors think is remarkable. Here are three exit poll results that caught my attention: 41% of…

-

Security issues of online accounting

This is the content of an email that I send to all clients: THIS MESSAGE IS FOR YOUR INFORMATION ONLY. NO RESPONSE IS REQUIRED. This message addresses online security issues related to our work together. There is no need to respond, this is just for your information. But if you wish to discuss any issue…

-

The sorry state of small business employee benefits

Why are small business employee benefit plans such a mess? This introductory explanation is offered by professional education provider CEU: “The vast majority of jobs in the United States are created by small companies that have fewer than two hundred employees. That market segment is the focus of this course, those small companies that are…

-

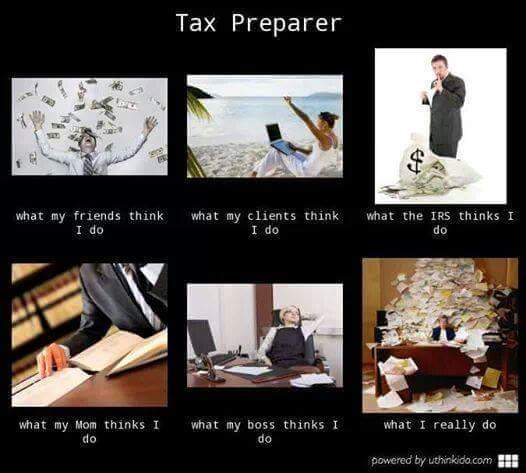

What I learned this tax season

Tax season is always an educational experience for me and I suspect that I’ll write at least a few blog posts on what I learned this year. But one issue jumped out as the most startling issue. I noticed how many married taxpayers filing joint returns actually act like two taxpayers filing individual returns. I…

-

3 out of top 20 business schools in Pennsylvania

It is great to see three Pennsylvania business schools listed in the top 20 ranking by this year’s Bloomberg survey. Villanova #1, Penn #16, and Penn State #19. I am blessed to have family or community connections with all three. http://www.bloomberg.com/features/2016-best-undergrad-business-schools/.

-

Winding down the tax season

I have less than 10 tax returns to compete or put on extension, my own included. In all cases these are ones where I’m waiting for information and will probably need to just make some guesses to get the extensions filed. My main job today is making calls and emails that say: “If I do…