Author: tonynova

-

Beware of these tax penalties

Yesterday my attention was drawn to several small business tax penalty issues. 1099-MISC Several situations came to my attention where small businesses and especially home-based businesses are not aware of their requirement to file form 1099-MISC for payments they made last year. Heed this basic rule: If your business pays $600 to an individual or…

-

Polls are even more useless than we knew

We were reminded of the huge limitations of voter polls this past week when every major news source who made a prediction in the Michigan primary proved to be wrong by a margin of 25% or more. The simple explanation seems to be that traditional polling methods do not reach a large portion of the population…

-

We are victims of our own choices

In the category ‘You can’t make this stuff up’ – I overheard this conversation yesterday at the Millvillle New Jersey Planet Fitness while travelling away from home. I made special effort to remember it word for word. The short discussion was between two middle-aged white people, one male one female, with an appreciable but typical tattoo-to-tooth ratio…

-

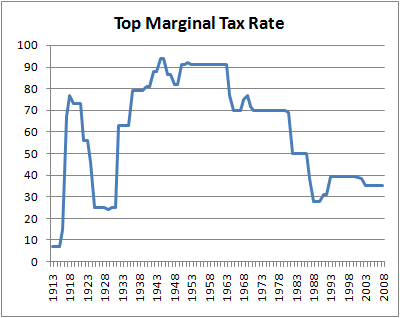

Why tax rates will be higher

We should recognize that tax rates for the wealthiest individuals and corporations will be higher in the future than they are today. I stirred up a handful of comments yesterday on Wall Street Journal social media about the future of income tax rates. Some people apparently think that higher income tax rates are not possible…

-

Ten easy and inexpensive employee benefit upgrades

Popular small business employee benefits that can be added within one day for less than $100 Small business owners often struggle to find affordable and manageable employee benefits for themselves and their employees. Here are 10 employee benefits that can be set up in a half hour at a cost less than $100. Health insurance…

-

Two week reminder for corporate tax filing deadline

The March 15, 2016 deadline for filing most corporate tax returns is approaching quickly. To avoid penalties either the tax return or a request for an extension must be filed on or before that date. In either case, taxes due must be paid by that date to avoid extra penalties and interest, If your 2015…

-

ERISA is still king per US Supreme Court

Comments on Vermont Green Mountain Care Board v. Liberty Mutual Insurance Company and what it means to small practitioners in the employee benefits field Yesterday the U.S. Supreme Court ruled on a case involving conflicting state and federal law surrounding operation of an employee benefit plan administrator. In a relatively easy 6-2 decision the Court sided with Liberty…

-

America’s evolving attitudes about inheritance

When it comes to money, we are still not communicating well with family and advisers. Estate tax laws aren’t helping. A new report by Hearts and Wallets provides some fascinating insights on America’s evolving attitudes about inheritances, including: “only 27% of the parents surveyed have told their children how much they are likely to inherit”…

-

My data management plan

It seems that my small business clients face a perfect storm of unimaginable and varied types of losses on a regular basis. I’ve personally suffered floods, thefts, head injury with amnesia, extended power outages, problems with fluctuating voltages, many hard disk failures, two unexplained SSD drive failures, Microsoft unannounced account cancellation, hacking attacks, human error, etc.…