Category: Accounting

-

The return of flat fee tax planning

This month I am bringing back the flat fee income tax planning service that I promoted a few years ago. I stopped marketing this service last year under criticism from other accountants that I was underselling the value of this type of expertise. I saw it as a great way to attract new clients that justified deliberately…

-

Tax collection: Uncivil or just dumb?

Yesterday the Pennsylvania Department of Revenue sent a collection agent to the business office of a local client over a $294 shortage of payroll tax withholding in 2011 through 2014 where the state then added over $750 of interest and penalties. The total bill with interest and penalties is a little over $1100. The business…

-

Soaring cellular data costs

I live and work in an area 50 miles south of Philadelphia, Pennsylvania and 20 miles east of Dover, Delaware in a rural part of New Jersey not served by cables or phone wires. We used to have regular telephone wires that were used for basic internet in the 1990s but service was always spotty and…

-

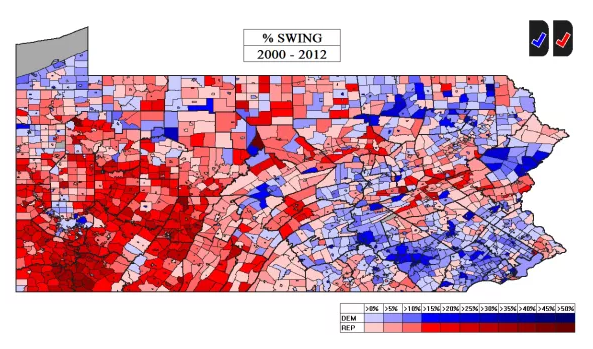

Pennsylvania divided

The election discussion is drawing attention to the widening political divide between my two major client groups. Nate Silver, writing for fivethirtyeight.com says “eastern Pennsylvania is becoming more Democratic while western Pennsylvania is becoming more Republican”. This confirms the trend that I noticed that even seems to be affecting my business practice. This graphic shows the…

-

Selling a rental property?

If you are planning to sell a rental property then it is likely important to estimate the taxes that will be due on the transaction. The calculation can be complicated but fortunately we have software available to help with the number-crunching. Just give a call and we can schedule time to run through the possible scenarios.…

-

Why people prepare their own tax returns

Most Americans have the capacity to prepare their own tax returns. But should they? In cases where self preparation is not logical and is not cost-effective, what is the underlying reason driving the decision to self-prepare tax returns? This blog post explores some observations, Self-prepared tax returns About half of all individual tax payers can and should submit their own…

-

Church and taxes

Congress gives at least four special tax considerations to churches*: First, churches are generally not required to pay income tax based on the result of their normal operations. This is the same as other tax-exempt organizations. Second, unlike other tax exempt organizations, churches are generally not required to file an annual informational filing with IRS.…

-

Professional tax preparation fees for 2016

Average tax return preparation rates are published by the National Association of Accountants in the national and regional average tax preparer fee survey for 2016. The fee for my online remote tax services is typically about 1/3 lower than typical walk-in tax preparers. However, late season returns or services that do not use online cost savings are…

-

No excuse accounting

Last week I wrote that there are no excuses for an accounting system that does not reconcile with the bank and financial accounts. This week Insightful Accountant carried this article about the improved reconciliation features within QuickBooks online accounting system. QuickBooks accounts for more than 3 out of 5 small business and nonprofit organization accounting systems. I think…

-

Tax filing deadline and penalties

With less than three weeks until late tax filing deadline for 2015, I have only one signed engagement to complete a tax return and many clients who still haven’t filed. I need to emphasize that unless they actually hire me, and not just presume that I’ll take care of their tax filing requirements by the…