Category: Employee Benefits

-

Health insurance spike hurts small contractors in PA

Health insurance price increases will hit small business contractors hard next year. A Pennsylvania contractor earning $100,000 per year will pay about $350 more per month. I’ve already heard from Pennsylvania contractor clients facing rate increases of $750 or month and a NJ contractor with more than $1,000 hike in his monthly bill for family…

-

Self-employed dental insurance

Most self-employed people have medical insurance but relatively few have dental insurance. Medical insurance is required by law but dental insurance is not. In the past, small business health insurance plans often included dental insurance as an option. These plans were eliminated by the Affordable Care Act. Even just a few years into implementation of…

-

update on split dollar life insurance

IRS updates tax treatment of split dollar executive compensation provided through life insurance

-

Merck lays off peers in Montco

One of the most respected employers in my community announced that it is closing its research facility and laying off 360 workers. Merck was a highly favorite employer among my Delaware Valley University undergraduate classmates and Temple University grad school peers. At one time I knew many who worked at Merck’s North Wales plant.…

-

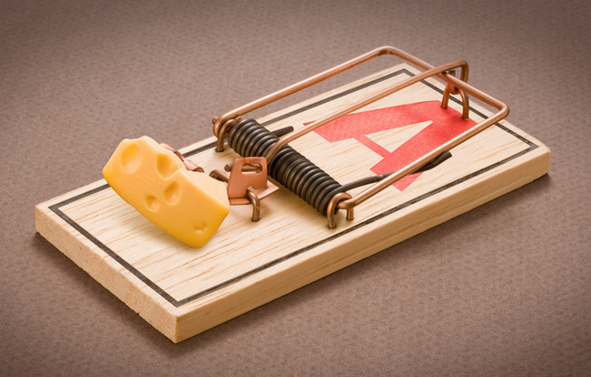

Tax traps remain for small business health plans

I had a no-charge telephone consultation today with a successful small business owner in California who has a very reasonable business plan to have his small business pay the substantial out-of-pocket medical expenses on a pre-tax basis. The tax savings can add up to $5,000 to $10,000 per year for a high income person with high…

-

Advice on emergency medical insurance

A digital video producer in Dallas, Texas wrote to me yesterday for advice selecting an emergency medical insurance plan. There are two main advantages of enrolling in an emergency insurance plan rather than paying these medical costs as out-of-pocket or through a small business reimbursement plan. First the insurance can be fully tax deductible where, in…

-

The goals of compensation and benefits planning

It occurred to me over this weekend that over more than three decades I’ve produced hundreds of recordings, articles, columns and radio spots on various technical aspects of compensation and employee benefits planning, but that I’ve never talked about the basic primary goals that we all share in this work. There are four primary…

-

New restrictions on partner’s employee benefits

Treas. Reg. § 301.7701-2T(c)(2)(iv)(C)(2), (TD 9766 May 4, 2016) has an adverse impact on planning of employee benefit plans for partners including participation in qualified retirement plans, health and welfare plans, and fringe benefit plans. The bottom line is that partners are not common law employees when the partnership owns a disregarded entity like an LLC that…

-

Uber wins independent contractor case in California

Worker classification has been one of the hottest issues of business management affecting large and small businesses alike. Yesterday one of the high profile cases in this arena was resolved when Uber announced that it negotiated the right to continue to classify workers as independent contractors in the state of California. Uber gave up the…