Month: February 2016

-

Tax organizer available as a free download

A tax organizer is used to help gather information necessary for income tax return filing. It does not replace the need for original documentation but rather supplements it and serves as a reminder of the information that is necessary. A new short 6 page organizer for individuals or small business owners, titled “2015 Tax Organizer“, is now…

-

When can a tax preparer accept your word?

When can a professional tax preparer accept your word without documentation and when must a tax preparer rely on other contradicting information? These issues came up several times this week in my work. The guiding principles are listed in IRS Circular 230 but are frequently not understood by taxpayers. While almost half of all tax…

-

“How much will health insurance cost when…”

It makes sense to plan ahead for the cost of health insurance. It is not surprising that I often receive questions about how much medical insurance will cost when I graduate, after I am divorced or when I leave a job to start a business. Fortunately,the Affordable Care Act includes a provision designed to keep health…

-

“I don’t have a social security number and want to buy health insurance”

I have a free 15 minute OnlineAdviser telephone consultation scheduled this afternoon with a FreedomBenefits.net web site user who wrote “I don’t have a social security number and want to buy health insurance”. Unfortunately, there is still plenty of confusion surrounding this issue so the request is not surprising. I expect that our conversation will clarify:…

-

Health insurance for farm workers

National Public Radio ran a story this month that says that half of the U.S. farm work force is undocumented and that many cannot afford health insurance. My state of New Jersey officially puts the estimate at 70% but I suspect that it may actually be higher, at least in my region. The article says of the…

-

Uber for tax preparation services

What if preparing your taxes were as simple as ordering a ride on Uber? What if: it could be done from your cell phone a firm price was set in advance prices were indexed to industry averages the tax preparer was screened for professional competency the work was supervised and the return submitted under the PTIN of a reputable…

-

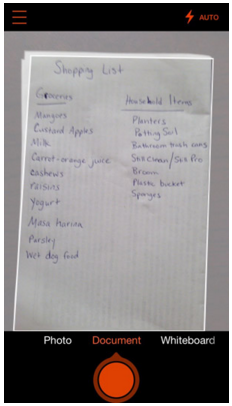

Mobile scanning apps for taxes and accounting

If you want to handle taxes or accounting on your smartphone or tablet, you need a mobile scanning app installed on your device. The two most popular apps that are completely free, have no premium upgrade option, include optical character recognition, and are available on all cell phone and tablet computer platforms are: Office Lens…

-

The $100 bill is doomed

The U.S. Department of Treasury says that we have a Trillion dollars in circulation in paper $100 bills. We’ve known for a while that much of this is kept outside of the United States and that a large portion of the $100 bills actually in circulation are used for illicit activities including drug trade, human…

-

Individual health insurance vs. group health insurance

Individual health insurance or group health insurance: which is better for your small business? Small business employers face a surprisingly difficult choice with the most basic of employee health insurance questions: Should the employer offer group health insurance or allow the employees find their own individual health insurance? This is no longer an inconsequential issue since we now…